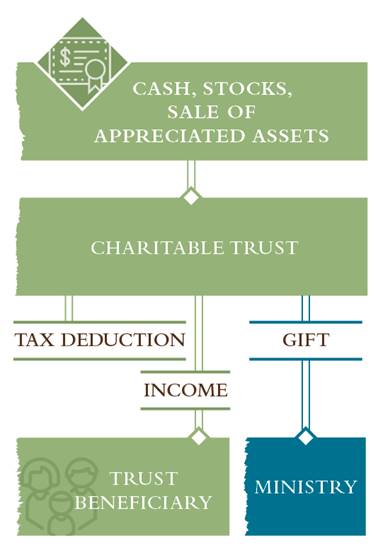

There’s a way to leave a gift that furthers gospel ministry, while lowering your taxes and providing income.

With a Charitable Trust, you can establish a resourceful stewardship strategy and help families thrive for generations to come.

Benefits of a Charitable Trust

- Receive income for life or for a term of years

- You can Avoid capital gains tax on the sale of your appreciated assets

- Receive an immediate tax deduction for the charitable portion of the trust

- Leave a legacy gift to Focus on the Family

There are lots of options when it comes to Charitable Trusts. Focus on the Family can help connect you to the answers you will need.

Featured Resource

Free eBook “Charitable Trusts”

For more information related to this topic, download this free eBook!